Annual results 2021

Ghent (Belgium), 30 June, 2022, 7 p.m.; bonyf NV (ticker symbol: MLBON), the next-generation oral comfort expert, presents its 2021 financial statements, approved by its Board of Directors and audited by its Statutory Auditors.

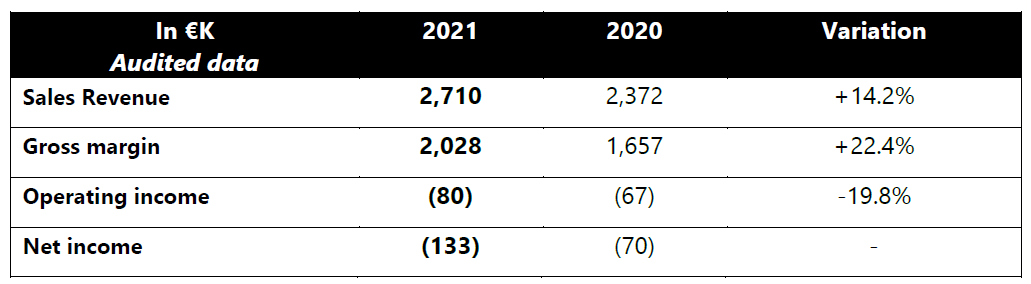

- 14.2% growth in revenue to €2,710K (vs. €2,372K in the fiscal year 2020), reflecting a good level of activity despite the effects of the pandemic

- Operating income at (€80K), taking into account the strong increase in marketing investments to develop future sales of the leading products PerioTabs® and OlivaFix® Gold

Confidence in continued growth in 2022

Resumption of growth in 2021

After the fiscal year 2020 was heavily impacted by the health crisis, bonyf achieved a 14.2% increase in revenues to €2,710K in 2021. This was driven by the gradual return to normal economic activity of its main distributors. Growth was still slow in some countries, due to delays in the resumption of supplies and continued closure of certain regions for part of the year.

Gross margin improvement and increased marketing investments

In the fiscal year 2021, bonyf maintained a high-level gross margin of €2,028K, giving a gross margin rate of 74.8% compared with 69.9% in 2020.

bonyf has amplified its marketing efforts in 2021 in order to relaunch the post-Covid sales momentum and promote its products in new geographical areas. An exceptional investment was made in the last quarter of 2021 in Italy to increase sales of its flagship product, PerioTabs®, a strategic geographic area for bonyf.

bonyf also incurred substantial non-current expenses related to the proposed listing of bonyf NV, which took place last March.

As a result of these specific costs, the operating income shows a slight annual loss of €80K close to the one recorded in 2020. After taking into account the financial expense of €50K and income tax of €3K, the net result is a deficit of €133K in 2021.

Balanced financial structure

As of 31 December 2021, bonyf’s shareholders’ equity amounted to €209K. Taking into account a gross debt of €230K and an active cash flow of €156K, the net debt amounts to €74K; 35% of the equity.

Favourable outlook for 2022

The announced conquest of new markets in Asia, the planned launch of new products and the ramping up of its two flagship products will contribute to achieving this objective in 2022.

bonyf’s listing on Euronext Access has already raised the group’s profile and will enable them to raise funds to finance the growth expected in the coming years.

bonyf’s strengths

- Products with patented formulations

- Produced in Switzerland compliant with stringent international quality regulations

- Proven clinical efficacy

- Commercial presence in 36 countries

- Prospects for solid growth and rapid profitability

- A fast-growing oral and dental care market

About bonyf

Incorporated in 1979, bonyf specialises in the development, production and selling of cutting-edge oral & dental care products. Through its unwavering commitment to innovation and continuous improvement, bonyf makes a real difference to people suffering from dental and oral conditions. The Company has its R&D facilities in Liechtenstein (in the reputable “Dental Valley”), a production plant in Switzerland and distributes its product range in 36 countries worldwide. Benefiting from seven patent protected formulations and products developed in-house, bonyf expects strong future development, driven by the fast-growing oral and dental care market

Press Release

Press Release